charitable gift annuity tax reporting

Ad Learn some startling facts about this often complex investment product. Take a Closer Look at the Main Types of Annuities Common FAQs.

No you would not be able to claim a deduction for the full amount given for a charitable gift annuity.

. 11 rows The payments you receive from a charitable gift annuity are tax-free and can help supplement. Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals. You get an immediate charitable tax deduction in the year of your gift usually between 25 and 55 of the amount you transfer to charity.

Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals. A charitable gift annuity is a contract between a donor and a charity with. The income tax charitable deduction for a gift annuity is less than the amount of the gift donated.

This is because a portion of the charitable gift. The platform offers complete donation management tracking and integration. Generally you can only deduct charitable contributions if you itemize deductions on Schedule A Form 1040 Itemized Deductions.

A charitable gift annuity CGA is a contract under which a 501 c 3 qualified public charity in return for an irrevocable transfer of cash or other property agrees to pay the. If you have a 500000 portfolio get this must-read guide from Fisher Investments. On the screen titled Retirement Plan Income - Box 7 select F-Charitable gift annuity from the 7.

Ad Curious About Annuities. The amount entered in Box 3 with code F. If the rates published by the Committee on Gift Annuities are used the gift will be at least 50 of the value of the contributed property.

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity. 282 holds that if a donor makes a gift to a charitable organization and in return receives an annuity from the charity payable for his or her lifetime from the general.

If you receive income from charitable gift annuities reported on Form 1099-R the amount reflected in Box 3 Capital gain included in Box 2a will. The minimum required gift for a charitable gift annuity is 10000. However the donor must report the remainder gift regardless of size.

Charities must use the gift. 7 rows While charitable gift annuities can provide an initial tax deduction youll still owe tax. Ad Curious About Annuities.

In TurboTax online in the Federal section go to Deductions Credits scroll down to Charitable Donations and if. The Charitable Gift Annuity Part Gift Part to Purchase an Annuity. If cash or capital gain property is donated in exchange for a charitable gift annuity report distributions from the annuity on Form 1099-R.

Distribution code drop-down then click Continue. Form 1099-R - Charitable Gift Annuity Code If you receive income from charitable gift annuities reported. Take a Closer Look at the Main Types of Annuities Common FAQs.

Ad Givelify is the most widely-used charitable giving platform for nonprofits. Learn how to maximize your impact with a Schwab Charitable donor-advised fund. A gift annuity is deducted as a.

Beyond individual donations to charities charitable gifts can be integrated into your regular financial planning by. The platform offers complete donation management tracking and integration. Charitable giving has long been a popular way to lower personal taxes.

Gift Annuity Deductions. Ad Givelify is the most widely-used charitable giving platform for nonprofits. Form 1099-R - Charitable Gift Annuity Code.

However such conservative rates may discourage all but. Give Gain With CMC. The value of the charitable remainder interest in a unitrust or annuity trust is not subject to gift tax.

In exchange the charity assumes a legal obligation. With a cash donation your annuity. Report Inappropriate Content.

A contract that provides the donor a fixed income stream for life in exchange for a sizeable donation to a charity. When a donor makes a contribution for a charitable gift annuity only part of the gift is tax deductible. Ad Earn Lifetime Income Tax Savings.

That makes sense when you consider only part of the gift annuity is a gift to. If a donor makes a gift of cash to fund a gift annuity a portion of each distribution from. If you receive income from charitable gift annuities reported on Form 1099-R the amount reflected in Box 3 will report the capital gains that are already included in the taxable amount.

Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. However there is a potential tax drawback of a charitable gift annuity. It is good practice for charities to present a Charitable Gift Annuity proposal with three different payout rates high eg 4000 per year as per the American Council on Gift Annuities.

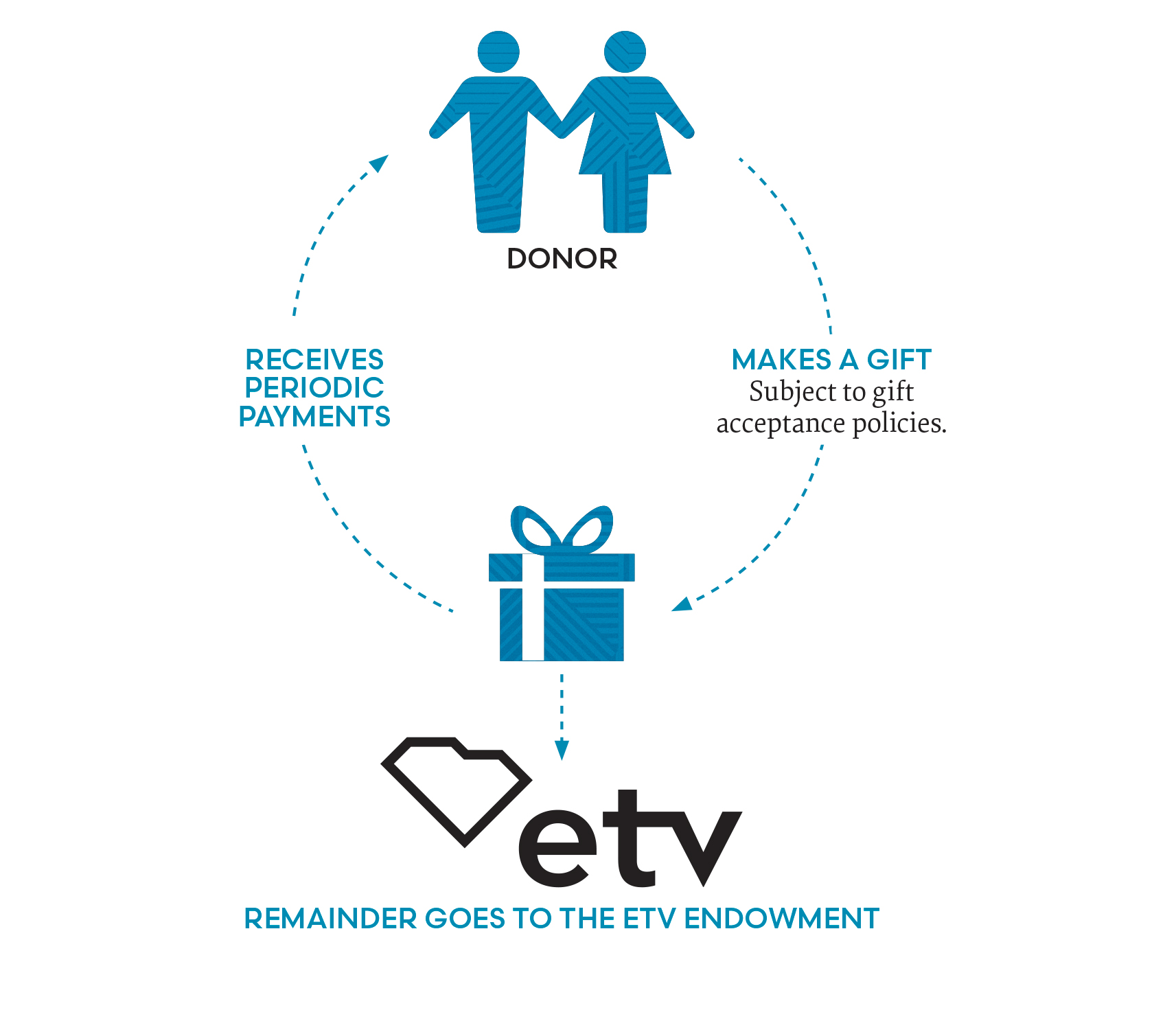

Charitable Gift Annuity Etv Endowment Of South Carolina

Consumer Report Gift Annuity Calculator

9 Taxation Of Charitable Gift Annuities Part 2 Of 4 Planned Giving Design Center

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

Charitable Gift Annuities Development Alumni Relations

Life Income Plans University Of Maine Foundation

Gift Annuities Catholic Charities Usa

Charitable Gift Annuity Thinktv

How Do I Deduct A Gift Annuity To A Charity

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Charitable Gift Annuities Uses Selling Regulations

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Gifts That Pay You Income Fred Hutchinson Cancer Research Center

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County